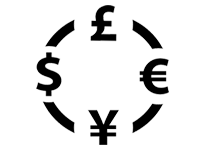

| NAME OF CURRENCIES | BUY | SELL |

| £ BRITISH POUND | £ 107.3 | £ 103.3 |

| $ AU DOLLAR | $ 56.7 | $ 53.9 |

| € EURO | € 91.5 | € 89.4 |

| ¥ JAPANESE YEN | ¥ 55.5 | ¥ 52.2 |

| CA$ CANADIAN DOLLAR | CA$ 62.5 | CA$ 60.1 |

| US$ USDOLLER | US$ 84.6 | US$ 81.8 |

| CHF SWISS FRANC | CHF 93.2 | CHF 90 |

| $ NEWZEALAND DOLLAR | $ 52.4 | $ 49.5 |

| RM MALYASIAN RINGGIT | RM 18.8 | RM 16.4 |

| S$ SINGAPORE DOLLAR | S$ 62.9 | S$ 60.4 |

| HK$ HONG KONG DOLLAR | HK$ 11.5 | HK$ 9.9 |

| SR$ SAUDI RIAL | SR$ 23.5 | SR$ 21.1 |

| د.إ $ UAE DIRHAMS | د.إ $ 23.7 | د.إ $ 21.4 |

| QR$ QATAR RIAL | QR$ 23.5 | QR$ 21.1 |

| BD$ BAHRAIN DINAR | BD$ 235 | BD$ 200 |

| KD$ KUWAIT DINAR | KD$ 268.1 | KD$ 230 |

| ر.ع. OMAN RIAL | ر.ع. 210 | ر.ع. 190.4 |

| ¥ CHINESE RMB | ¥ 12.7 | ¥ 10.6 |

| ฿ TBH | ฿ 2.6 | ฿ 1.9 |

| ZAR South African Rand | ZAR 5.1 | ZAR 3.25 |

Tempor stet labore dolor clita stet diam amet ipsum dolor duo ipsum rebum stet dolor amet diam stet. Est stet ea lorem amet est kasd kasd et erat magna eos

Tempor stet labore dolor clita stet diam amet ipsum dolor duo ipsum rebum stet dolor amet diam stet. Est stet ea lorem amet est kasd kasd et erat magna eos

Content will come here

The Federal Reserve will announce on Wednesday its first monetary policy decision of 2024. This event has the potential to create attractive trading opportunities, but it may also bring heightened volatility and unpredictable price movements, so traders should be prepared to navigate the complex market conditions later this week. In terms of expectations, the FOMC is seen holding its key benchmark interest rate unchanged in its current range of 5.25% to 5.50%. The central bank may also drop language indicating a likelihood of additional policy firming from the post-meeting statement – a move that would mark a de facto shift toward an easing stance.

The Federal Reserve will announce on Wednesday its first monetary policy decision of 2024. This event has the potential to create attractive trading opportunities, but it may also bring heightened volatility and unpredictable price movements, so traders should be prepared to navigate the complex market conditions later this week. In terms of expectations, the FOMC is seen holding its key benchmark interest rate unchanged in its current range of 5.25% to 5.50%. The central bank may also drop language indicating a likelihood of additional policy firming from the post-meeting statement – a move that would mark a de facto shift toward an easing stance.

Erat ipsum justo amet duo et elitr dolor, est duo duo eos lorem sed diam stet diam sed stet lorem.

Erat ipsum justo amet duo et elitr dolor, est duo duo eos lorem sed diam stet diam sed stet lorem.

Erat ipsum justo amet duo et elitr dolor, est duo duo eos lorem sed diam stet diam sed stet lorem.